時間: 人気:0タイムズ

I have been engaged in the waste tote bin cleaning and recycling industry for nearly two years, overseeing every aspect of the process—from project design and obtaining the Hazardous Waste Operating Permit to enterprise production. This includes project approval, environmental protection bureau applications, drafting environmental impact assessment (EIA) reports, equipment procurement, production and storage workshop design, waste gas and wastewater treatment process design, equipment installation, EIA report reviews, Hazardous Waste Operating Permit applications, and post-production activities such as equipment debugging, workshop management, cleaning agent research, and market development. Through this journey, I have accumulated invaluable experiences and insights, which I now share to benefit industry professionals and newcomers alike. My aim is to promote the healthy and orderly development of this sector, aligning with national interests and corporate responsibilities under China’s Solid Waste Law.

Waste packaging tote bins originate from diverse industries, including steel, automotive, paint and coatings, power generation, wind energy equipment, chemicals, lubricants, mineral oils, cutting fluids, resins, adhesives, cement, and automotive repair. These bins, classified as hazardous waste (HW08 [900-249-08] and HW49 [900-041-49] under China’s National Hazardous Waste List), pose significant environmental risks. Per the Environmental Protection Law, polluters are responsible for treatment costs, which typically range from 2,000 to 5,000 yuan per ton. Hazardous waste disposal enterprises transport these bins using specialized vehicles tracked via national and provincial solid waste management platforms.

Key Market Drivers:

The industry primarily handles 1,000L PE tote bins, 200L steel/plastic bins, and smaller bins. Equipment selection hinges on bin type and volume:

Optimal Equipment Mix:

Production Capacity:

Balancing scale with cost efficiency is critical. Overly large facilities require excessive investment in storage and wastewater treatment, while undersized operations incur high per-unit environmental compliance costs.

Traditional Methods:

Modern Solutions:

Paint Removal:

A proprietary paint stripper is used for painted bins, with wastewater treated via filtration and carbonization.

Per the Solid Waste Law, disposal follows reduction, recycling, and harmlessness principles.

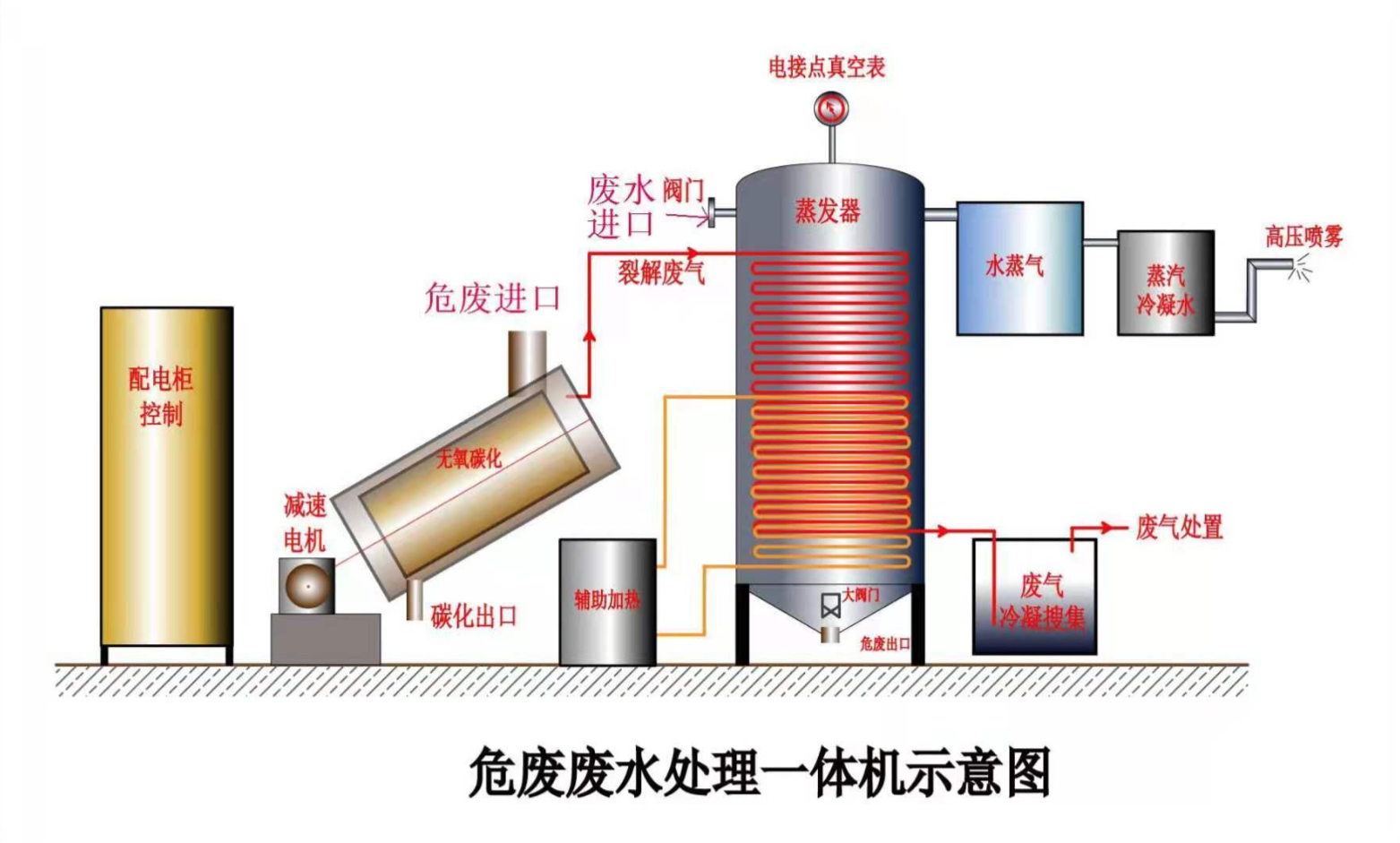

Wastewater Treatment:

Solid Waste:

Key Emission Sources:

Treatment Technology:

System Cost:

結論:

The IBC tote bin recycling industry holds significant potential as a sustainable, profitable venture aligned with national environmental policies. By leveraging innovative technologies, optimizing processes, and adhering to regulations, stakeholders can drive the sector toward a greener, more efficient future.

会社電話

+86-21-6420 0566

営業時間

月曜日から金曜日

携帯電話:

13816217984

メール:

info@qinsun-lab.com